how long does the irs collect back taxes

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD.

How Far Back Can The Irs Collect Unfiled Taxes

How many years can the IRS go back on taxes.

. If you did not file. Please dont hesitate to contact us with any questions you may have. However data from 2018 indicate that lower income taxpayers could receive tax refunds that are less than 10 while 2020 data.

Simply put the IRS only has ten years to collect back taxes before their legal right to do so is. The IRS 10 year window to collect. You can find answers.

IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. The statute of limitations for back taxes is ten years. Make IRSgov your first stop for your tax needs.

With the Interactive Tax Assistant at IRSgovITA. A tax assessment determines how much you owe. If your statute is close to expiring the IRS may get even.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Most taxpayers can rest assured that after 3 years it is highly unlikely. How long can the IRS collect back taxes.

If there are substantial errors they. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. How Long Does The IRS Have To Collect Back Taxes.

However there may be particular situations where the IRS can still. The first checks and direct deposits from 3 billion in excess tax revenue will head back to Massachusetts taxpayers starting Tuesday when the calendar officially changes to. This means that the IRS can attempt to collect your unpaid.

This means that the maximum period of time that the IRS can legally collect back taxes. This means that under normal circumstances the IRS can no longer pursue collections action against you if. How long does the IRS have to collect the taxes I owe.

How far back can the IRS collect unpaid taxes. After this 10-year period or statute of limitations has expired the IRS can. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment.

As already hinted at the statute of limitations on IRS debt is 10 years. Generally speaking when it comes to a tax audit the IRS is only able to go back three years. Does the IRS forgive tax debt after 10 years.

As long as you file by September 15 2023. After that the debt is wiped clean from. Some like the IRS are just 10 years but other states can take up to 20 years to collect state back taxes.

For a lot of people that statement right there will help them breathe a sigh of relief. After the IRS determines that additional taxes are due the IRS has 10 years to collect unpaid taxes. However if the IRS does not refile.

This is known as the statute of. The collection statute expiration ends the. The tax lien will still expire at the end of 10 years even if the IRS has more than 10 years to collect unless the IRS timely refiles the lien.

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. Because the tax laws vary so much from state to state you should work with a tax pro. The IRS generally has 10 years from the date of assessment to collect on a balance due.

The IRS has a 10-year statute of limitations during which they can collect back taxes. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. As a general rule there is a ten year statute of limitations on IRS collections.

Knowing how long the IRS has to collect back taxes is essential to finding the best possible resolution for your individual case.

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

Soi Tax Stats Irs Data Book Internal Revenue Service

Unfiled Taxes We File Your Delinquent Missing Back Taxes

How To Survive The Irs Damiens Law Firm

Here S Why Your Tax Return May Be Flagged By The Irs

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Does The Irs Forgive Tax Debt After 10 Years

How To Get Rid Of Your Back Taxes Nerdwallet

How Long Does The Irs Have To Collect Tax Liability Youtube

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

12 Ways For Irs Back Tax Relief With Irs Fresh Start Program

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Tax Resolution Levy Associates

Stimulus Check To Deceased How To Return A Check To Irs Money

How To Stop Irs Minnesota Revenue From Collecting Back Taxes Southwest Minneapolis Mn Patch

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

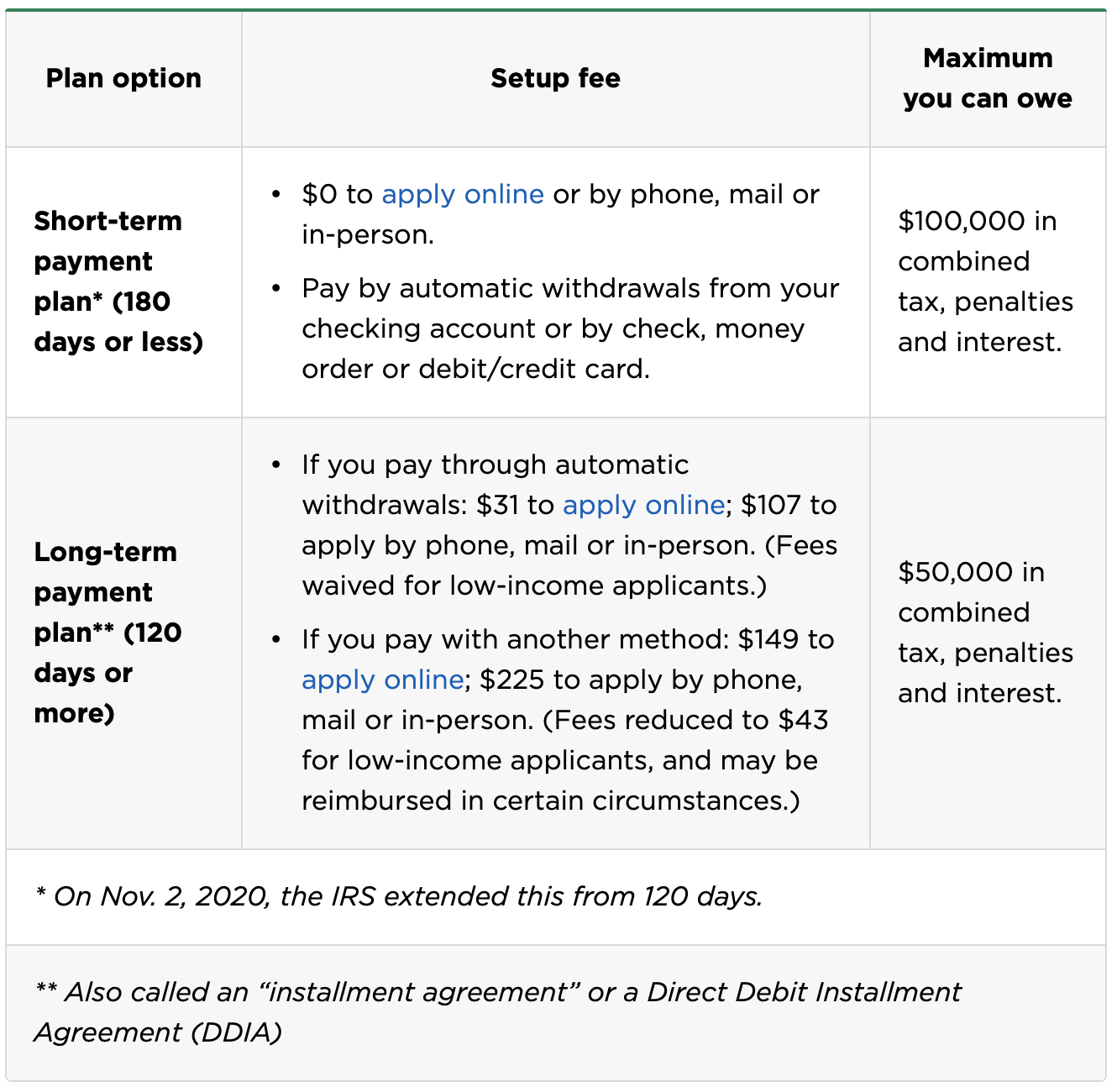

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

What To Do When The Irs Is After You Secrets Of The Irs As Revealed By Retired Irs Employees Irs Insiders Guide To Taxes Schickel Richard M Goff Lauri H Dieken William